FOR ADVISORS, BROKER DEALERS AND WEALTH ADVISORS

Intuitive and Actionable Portfolio Risk Oversight

Historically low risk free rates can drive investors to reach for yield in higher risk assets. Monitoring those risks with a structured and automated daily process can support both client confidence in their investment plans and validate your value as their advisor. Pending Department of Labor regulations could impose more fiduciary responsibility to align investment risk with client suitability and tolerances on a continuous basis.

Built to Automatically Monitor Risk in Your Client Portfolios and Provide You with Actionable Insights

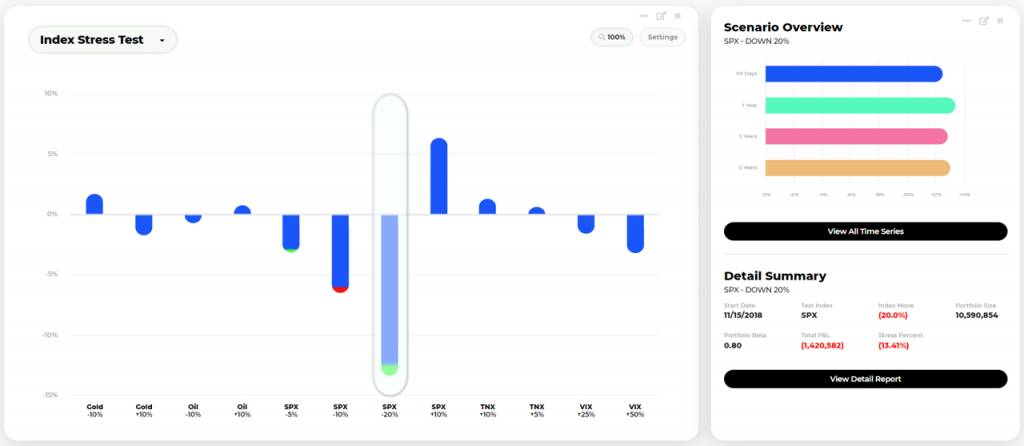

Automated daily stress testing of your clients’ portfolios with 25 customizable risk scenarios and email risk alerts sent to you when a particular client portfolio exceeds agreed risk levels. Drill down to position-level risk drivers. View reports for any day or plot risk patterns over time.

• Help clients stay on-plan by minimizing emotions in decision-making

• Incentivize clients to consolidate assets with you by providing a more complete risk picture

• Win new clients by offering a higher level of value with automated daily risk monitoring

• Access reports that are always up to date for your next client meeting or unscheduled call.

• No software to install, learn or run

• No manual daily entry of holdings

Daily client portfolio risk chart using customizable scenarios such as declines in the S&P 500, a spike in ten-year interest rates, or shocks to oil and gold prices.