FOR INVESTMENT MANAGERS

Intuitive, Actionable, Simple to Communicate

Not every strategy or manager is in a race with the stock market. Unfortunately, many excellent strategies are commonly overlooked by both wealth advisors and institutional investors when they are eliminated from consideration by a return filter applied somewhere in the review process. Strategies such as equity long/short, market neutral, arbitrage, and many other conservative long-only or broadly diversified portfolios are all vulnerable to this “invisibility” risk.

ATA RiskStation™ can position managers to more effectively communicate the current risk profile of their strategies and the persistence of those risk profiles over time using a wide range of customizable scenarios. Furthermore, ATA RiskStation™ can allow even the smallest managers to quickly and cost effectively demonstrate to both investors and regulators a robust, structured and repeatable daily process for both monitoring and reporting on portfolio risk.

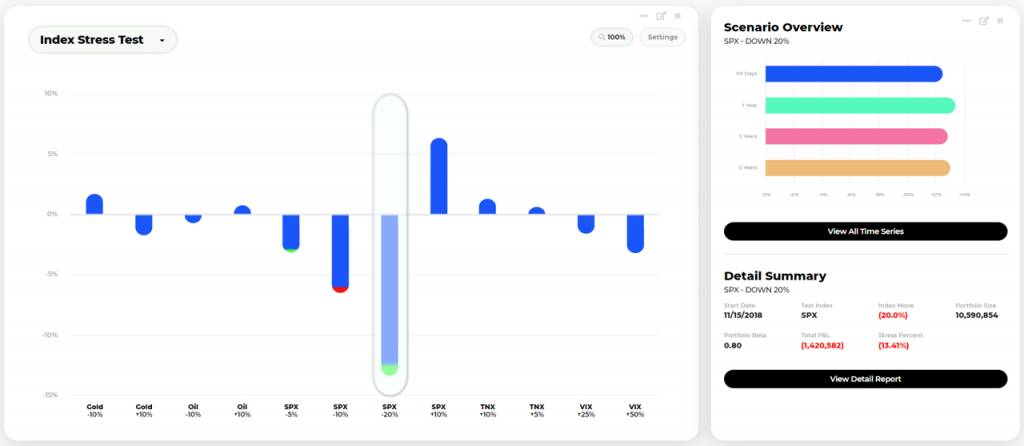

Daily client portfolio risk chart using customizable stress scenarios such as declines in the S&P 500, a spike in ten-year interest rates, or shocks to oil and gold prices.

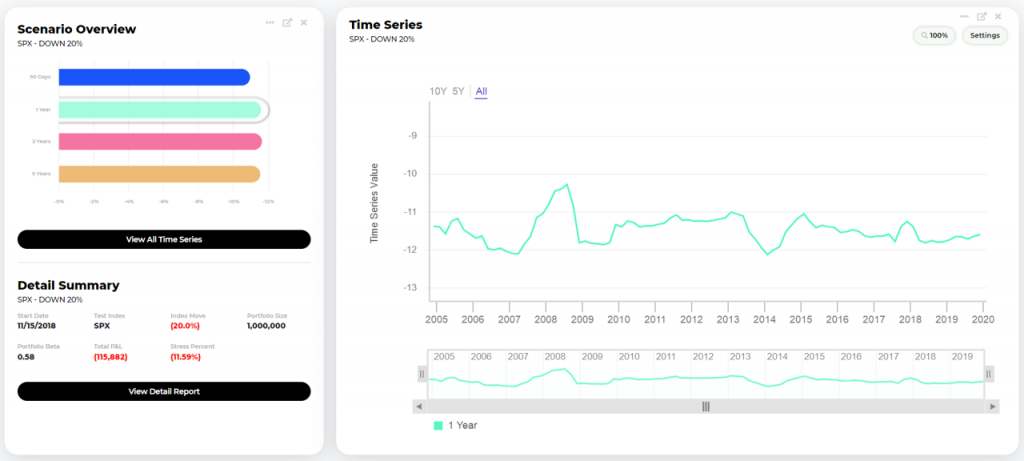

Time Series View for any scenario and any portfolio reporting level over time

Built to Automatically Monitor Fund Portfolio Risk on a Daily Basis with Intuitive Reporting and Customizable Risk Alerts.

Automated daily VaR modeling and stress testing with up to seventy-four (74) customizable scenarios and email risk alerts sent to you when the portfolio exceeds pre-determined risk levels for any scenario. Drill down to position-level risk drivers. View reports for any day or plot risk patterns over time.

• Don’t rely on a single measure of risk. Gain a broad view of risk with multiple available models, parameters and time-frames that will automatically run daily against your positions.

• More effectively communicate your strategy’s current risk profile and the stability of that profile to clients and prospects

• Demonstrate a robust, structured and repeatable daily risk oversight process to regulators, prospects and clients

• Access web reports that are always up to date for your next meeting or due diligence questionnaire.

• No software to install, learn or run

• No manual daily entry of holdings