FOR INSTITUTIONAL INVESTORS

Intuitive and Actionable Portfolio Risk Analytics

Senior executives at pension plans, endowments and foundations operating with limited staffs and budgets are still expected to oversee large externally-managed portfolios while providing timely and actionable reporting to oversight stakeholders. Historically low risk-free rates depress expected portfolio returns and make it more difficult to achieve actuarial return targets without assuming increased risk.

If you are running a pension plan, foundation or endowment, we hear you. ATA RiskStation™ can quickly position you and your team to more effectively assess and report on your current portfolio risk profile and the stability of that profile over time using a wide range of customizable scenarios. Furthermore, ATA RiskStation™ can allow even the smallest teams to quickly and cost effectively set automated e-mail alerts to monitor current risk levels for the whole portfolio or any individual allocation.

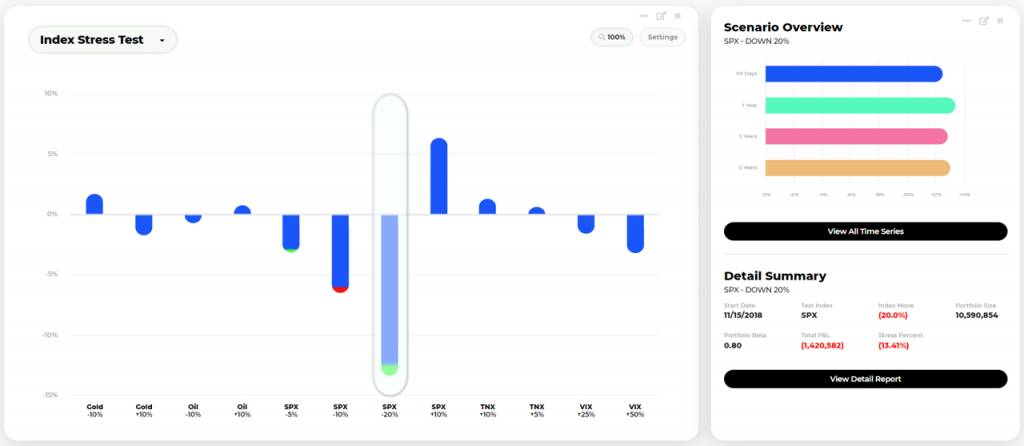

Daily client portfolio risk chart using customizable scenarios such as declines in the S&P 500, a spike in ten-year interest rates, or shocks to oil and gold prices.

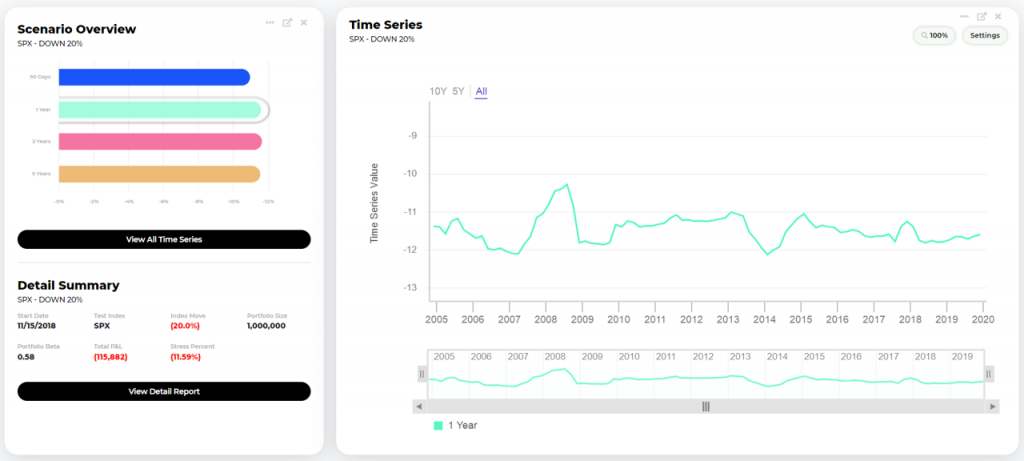

Time Series View for any scenario and any portfolio reporting level over time

Built to Automatically Monitor Fund Portfolio Risk on a Daily Basis with Intuitive Reporting and Customizable Risk Alerts.

Automated daily VaR modeling and Stress Testing with up to seventy-four (74) customizable scenarios and email risk alerts sent to you when the portfolio or any allocation exceeds pre-determined risk levels for any scenario. Drill down to position-level risk drivers. View reports for any day or plot risk patterns over time.

• Don’t rely on a single measure of risk. Gain a broad view of risk with multiple available models, parameters and time-frames that will automatically run daily against your positions.

• More effectively communicate your strategy’s current risk profile and the stability of that profile to your investment committees and oversight boards.

• Implement a robust, structured and repeatable daily risk oversight quickly and cost effectively.

• Access web reports that update daily so you are ready for your next internal or manager meeting.

• Set automated risk alerts that will automatically compare daily current embedded risks against your predetermined tolerances for any scenario.

• No software to install, learn or run

• No manual daily entry of holdings