Click here to learn more.

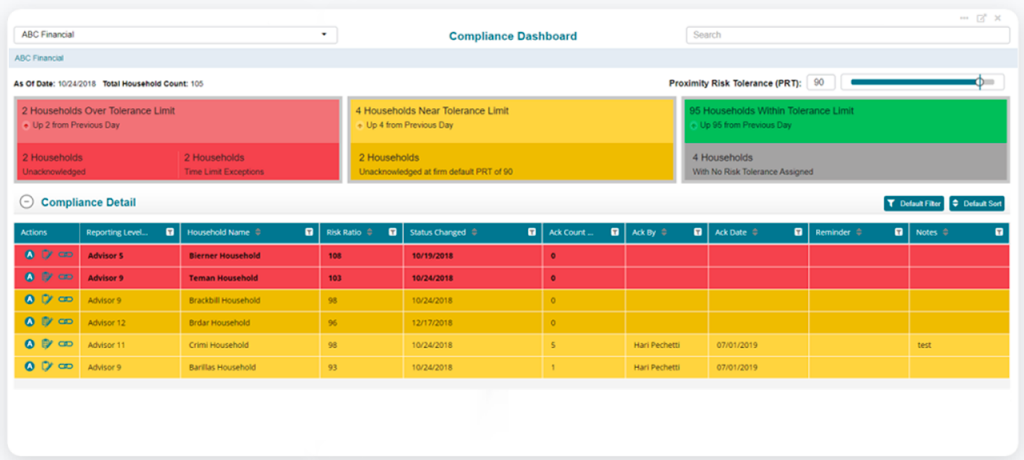

As advisors move toward a fiduciary role, suitability issues will become more complex. Previously, if an advisor placed an investment in a client account, it just needed to be “suitable” at the time it was made. Now, as advisors assume a fiduciary duty to clients, they will need to pursue closer alignment between currently embedded portfolio risks with the client’s current goals and risk tolerances.

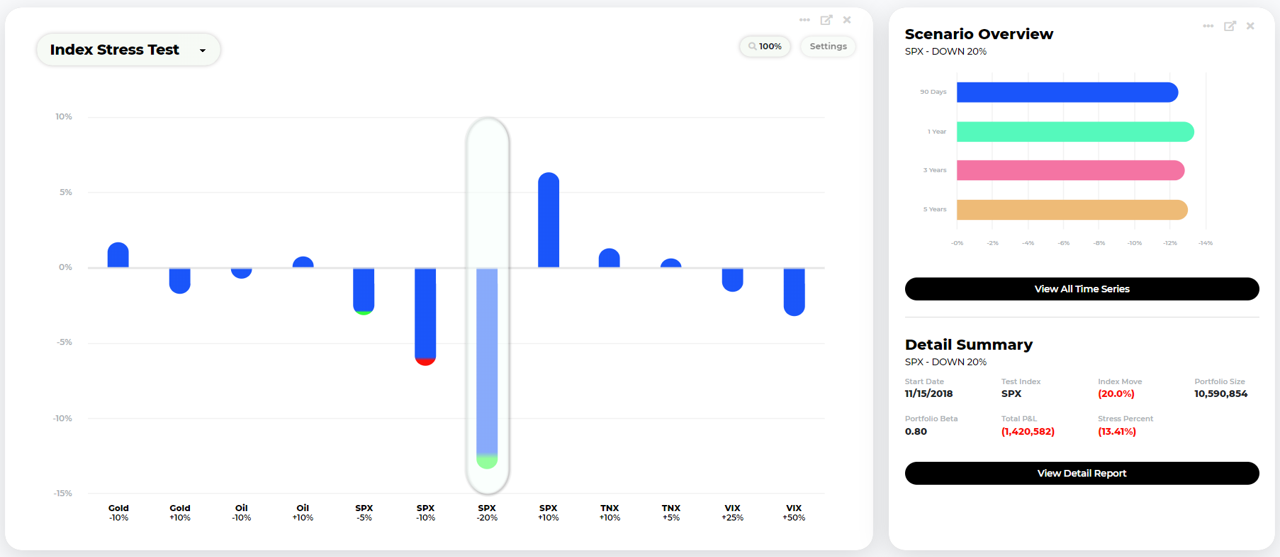

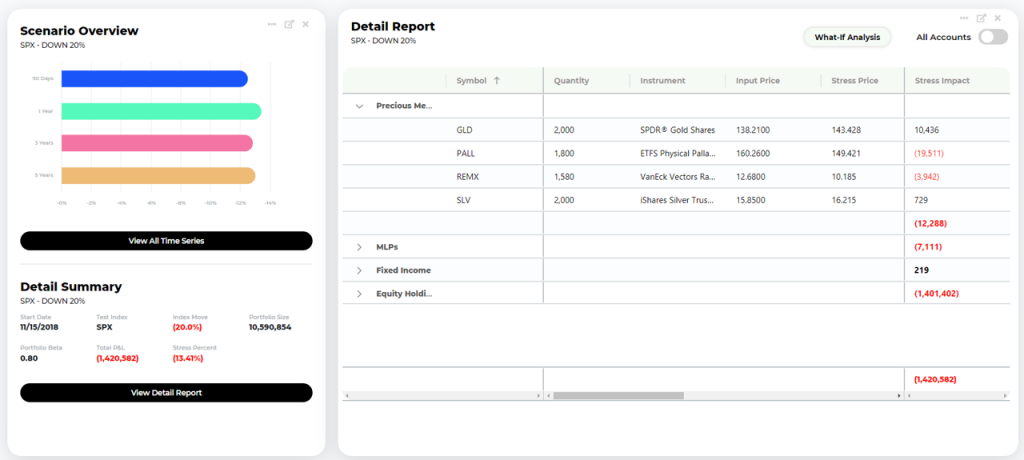

ATA RiskStation™ technology can, on a daily basis, systematically monitor and report on portfolio risks for any defined scenario against the risk tolerances expressed by the client to an advisor at the most recent meeting. If risk mismatches for any client are identified during nightly processing, e-mail risk alerts are automatically sent to the advisor and all other authorized oversight groups or individuals at the firm.